Finding the right funding sources for startups can be a daunting task for many entrepreneurs. However, understanding the various options available can help you make informed decisions and secure the capital needed to launch your business. Startups often rely on a combination of funding sources to create a robust financial foundation. One of the most common avenues is personal savings. Many entrepreneurs begin their journey by investing their own money, which not only provides initial capital but also demonstrates commitment to potential investors.

Obtain access to Equity report tools to private resources that are additional.

Another popular option is seeking funds from family and friends. This method can be less formal and often comes with more flexible repayment terms. However, it’s crucial to approach these relationships with care; clear communication about the risks and expectations can help minimize potential conflicts. In addition to personal connections, startups can explore angel investors. These individuals typically invest their personal funds in exchange for equity and often bring valuable expertise and networks to support the business.

Obtain recommendations related to how to invest in a small business that can assist you today.

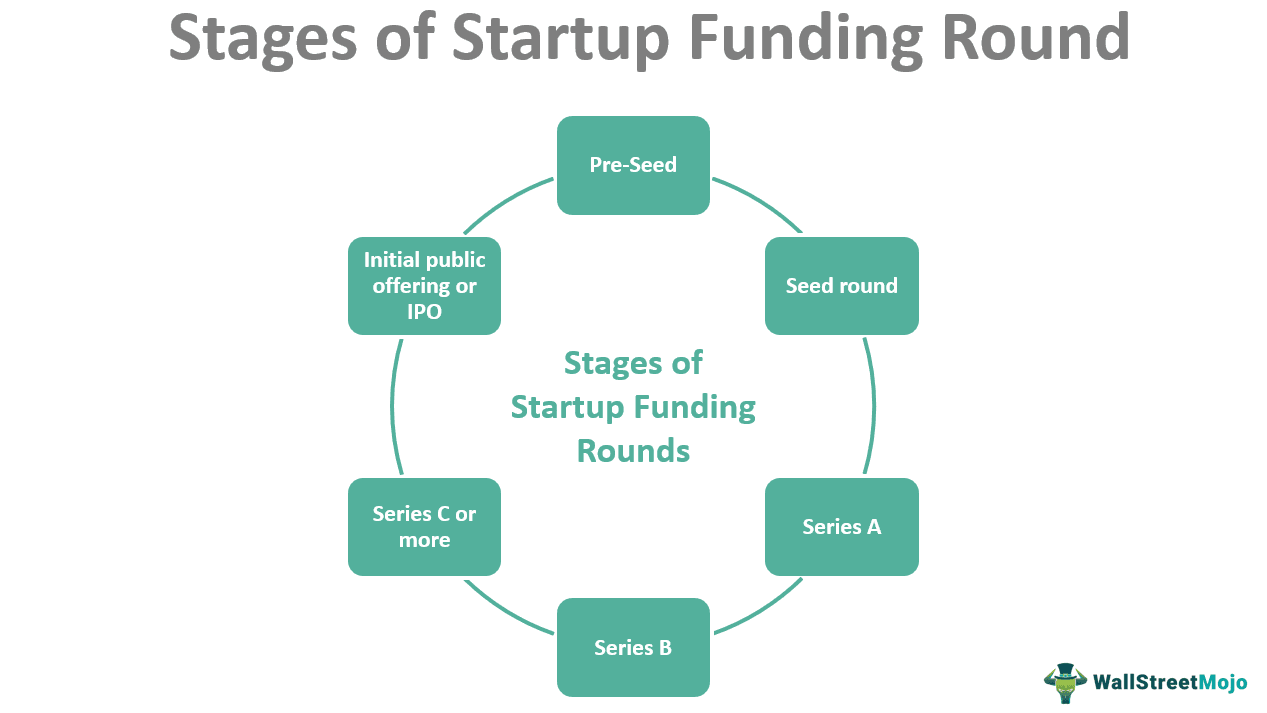

Venture capital is another significant source of funding for startups, particularly those in high-growth sectors. Venture capitalists (VCs) provide substantial amounts of capital, but they also seek a strong return on investment and may require a considerable stake in the company. This type of funding is ideal for businesses poised for rapid expansion, as VCs can offer not just money but also strategic guidance. Additionally, some startups turn to crowdfunding platforms. These online platforms enable entrepreneurs to present their business ideas to a broad audience, allowing individuals to contribute small amounts of money in exchange for rewards, equity, or other incentives.

Lastly, government grants and programs can be a fantastic resource for startups. Many governments offer financial assistance to encourage innovation and entrepreneurship. These funds usually do not require repayment, making them an attractive option for new businesses. However, the competition for such grants can be fierce, and applicants often need to meet specific criteria. In conclusion, by exploring a mix of these funding sources for startups, entrepreneurs can effectively finance their ventures and increase their chances of success. Remember, the key is to assess each funding option carefully and choose the combination that best aligns with your business goals and needs.